Capitalist Processes in the Making

Creation and Circulation of Capital

Within the contemporary world economy, the dominant sets of relationships are increasingly capitalist in nature. Further, through rapid globalization a globalizing capitalist economy is emerging. This landscape means abstract understanding of capitalism can be deployed to, first, understand the relational basis of capital's existence and the pressures for particular behaviors that spring from crucial interactions amongst the relationships, and second, the implications of the dynamic of capital circulation that spring from the existence of a globalizing capitalist economy.

In simplified terms capitalism and the emergence of capital originates from specific conditions. David Harvey, the geographer whose work has been hugely influential, phrases a sequence of interlinked conditions and consequences. He is quite sweeping in his purview, from the initial conditions that create capital to geopolitical inferences. His argument, drawing on Marx, is that capitalism is a historical and geographical process that continually creates value, when people enter daily into capitalist relations, though not always of their choosing. Thus, in the first instance direct producers (laborers) are separated from the ownership of the means of production and the ownership of the product of the labor process. This fundamental insight was grounded empirically from examination of the enclosure movement at the time and is still a crucial process occurring in the twenty first century. Direct producers must sell their labor power to capitalists (who own the means of production) being transformed into a commodity. They are bought and sold in a labor market regulated by price signals. Capitalists make every effort to secure a surplus of value from the difference between the costs of hiring labor and using other inputs and the realized value of product sold, so creating surplus value and profits. Realization at a profit means capital – value – is available and potentially in circulation. Capitalists try to retain and expand their wealth by putting capital back into circulation, in order to accumulate. A class relation exists between capitalists (who buy rights to labor power in order to gain a profit) and laborers (who sell their labor for a wage in order to live). The class relation implies conflicts over pay and work conditions. Capitalists seek to be competitive by changing the means of production by developing the forces of production such as technological change, materials improvements, new knowledge, changing labor skills. The organization of production occurs through both the technical and social division of labor. Pressures from intercapital competition and class struggles encourage technological and organizational change, which intensifies work and usually requires investment of capital and labor power. The circulation of capital is unstable as expansion depends upon the application of living labor in production whereas technological change typically displaces workers. Absorbing surplus capital (unused production capacity) and labor (unemployment) is not automatic, leading to crises and political unrest. Surpluses that are not absorbed are devalued, sometimes destroyed. Share markets collapse, inflation runs rife, default rates on debts climb, property prices fall, and so on. The potentialities of capital in circulation are aptly captured in Joseph Schumpeter's famous phrase, creative destruction.

A more user friendly statement of the contradictory position around the investment–workplace relation would highlight professional managers for capitalists and wage and salary earners rather than laborers. Today the prime movers of capital are corporations operating in business, government, and community shares. Harveys's chapter 5 in The Limits to Capital gives a glimpse into the constraints and possibilites of corporate operations by fusing understandings from Alfred Chandler's company studies with political economy logic. He shows that contrary to accepted wisdom the atomistic world of perfect competition offers enormous obstacles to capital circulation. He suggests that the divisionally structured organization (this includes the government sphere if run under commercial performance criteria) internalizes comparisons of performance (division to division instead of company to company). External benchmarking and monitoring systems simply widen the net and horizons of calculation. Since these systems are being rapidly adopted knowledge of both relative and absolute positioning of small and large entities, in multiple evaluative frames (e.g., industries, regions, best practices) provide signals on many performance measures. Double entry accounts consisting of income and expenditure and assets and li abilities ledgers keep track of how individual entities fare. In the increasing 'round about ness' of capital circulation, in configurations such as supply chains, many sites exist to generate and appropriate value and profits. Who gains and loses is a timeless and ever geographic question.

Paths of Capital Circulation

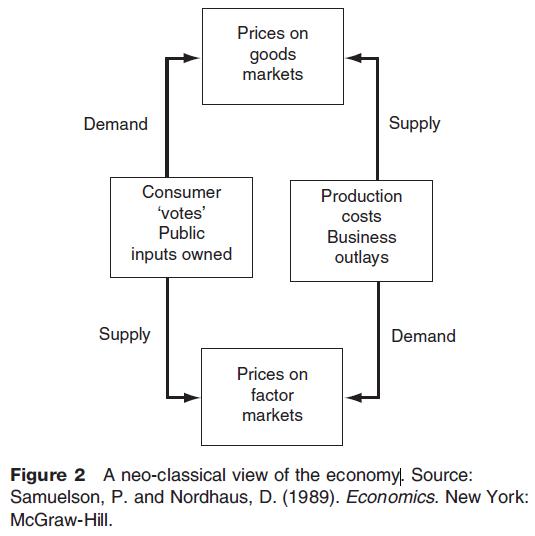

Toward the end of The Limits to Capital David Harvey diagrams the paths of capital circulation (Figure 2). This refreshed Marxian political economy, by putting a set of general theoretical observations into a single figure that both revealed and reframed the research agenda of social scientists, as well as geographers. The shift in register accomplished by the diagram was threefold; it reinstated the importance of circuits as a way to understand the dynamics of capitalist processes, it revealed multiple circuits, and the different temporality to the circuits. It also hinted at geographical dimensions in new ways – adding in the built environment for the first time. Despite its many positives, Figure 2 still had a productionist and industrial stamp and was highly abstract. But as Harveywould be quick to remind us, Marx said capital is value in motion, and the diagram shows where that value might flow. Figure 2 can also be seen as a Marxist political economy counter to the neoclassical view seen in Figure 1.

Interconnecting and Supportive Processes

Contemporary economic geographers such as Kathie Gibson, Julie Graham, Wendy Larner, Roger Lee, and others have been especially diligent in their attempts to outline how capitalism is a constituted process, that is, the development of the key relationships is not independent of geographical and historical processes. Reflecting back on the prolific output of geographers inspired in the 1980s–1990s by political economy a number of threads are discernible as significant contributions to the abstracted understandings of capitalism. The mapping includes:

- Processes that have aided the separation of people from their ability to produce for subsistence, including movements of enclosure, privatization schemes, and the active creation of markets or marketization.

- Processes exposing how capitalist processes are implicated in alterations in household divisions of labor, the separation of residence and workplace, the feminization of some areas of work, and changes in the participation rates of men and women.

- Processes connected with unions, labor processes, and labor markets, including under regional and international trade arrangements.

- Processes that have developed the forces of production, especially mechanization and industrialization in agriculture, manufacturing, and services that have transformed human and nonhuman worlds. One political economy book title from the 1980s read by many geographers gives a feel for this – From Farming to Biotechnology.

- Processes that have altered the regulatory and governance frameworks, including the rise of food regimes and resource import complexes in the globalizing economy.

- Processes that have changed the spatial arrangements of where and how people can live, particularly urbanization, suburbanization, peri urban developments, and city-regions.

- Processes that have shifted the focus of infrastructure in economies especially between production and consumption, strengthened by the work of geographers interested in cultural economy, including highway systems, industrial and science parks, waterfront developments, shopping malls, airports.

- Processes that extend the depth of calculation and surveillance, that are increasingly at a distance technologies giving new capacities to know competitors.

Regimes of Accumulation and Regulation

The study of the institutional foundations of markets was led early by sociologists, especially Max Weber and Karl and Michael Polyani who emphasized the importance of (1) the legal and political framework established by the nation state that provided unprecedented structured possibilities for capitalist development and (2) the bases upon which actions were decided, which have been steadily developing through successive generations of comparative practices anchored in the principle of rationality, for example, audit, standards, benchmarking, best practice, certification, and so on.

These interests have been replayed by geographers drawing on 'the regulation school' from European political economy. This school argues that two distinctive regimes of accumulation with particular regulatory modes had already appeared in capitalism. The first, extensive accumulation, rested on actors foraging the world for fresh resources and products. The emphasis was on luxury and capital goods for the emergent economies of the UK, Germany, and USA. The second, intensive accumulation, involved mass production to cater for mass consumption stimulated by state assistance. This underpinned the post-World War II long boom.

- Contesting Abstractions

- Trying to Understand a Changing World

- Capitalism

- Large Corporations, Political Regulation, Fordism, Mass Production, and Economies of Scale

- Geographies of Modern Capitalism

- Geographies of Early Capitalism

- Theoretical and Conceptual Ideas

- Capitalism and Division of Labor

- Toward an Inclusive Geography of Care and Caregiving