How Does Capital Work?: Mechanisms of Capital

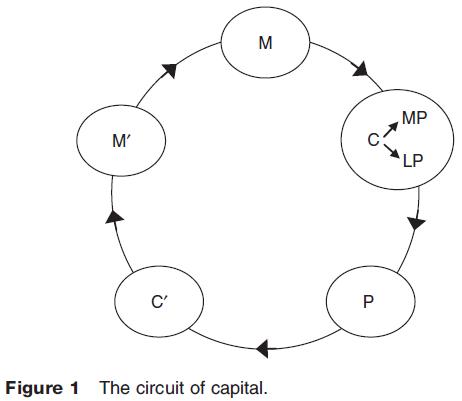

To understand how capital works, the author returns to Marx's general formula for capital as he outlines in chapter 4 of Capital vol 1: M–C–M0, which can be expanded into: M … C [MP, LP] … P … C0 …M0 (see Figure 1).

The general formula means that: the owner of capital invests money (M) to buy commodities (C) which include means of production (MP) (e.g., machine, energy, and raw material) as well as labor power (LP) in order to produce a new commodity (C0) which is then sold for M0. M0 includes the initial money invested (M) and a surplus (0). The owner of capital keeps a part of M0 as profit and another part is shared with bankers (interest), and landowners (rent) (if necessary). A part of the profit is spent on private consumption (including luxury consumption) and another part is reinvested in the second cycle to enlarge the scale of production. This process of reinvestment of profit is known as accumulation. M, C, y C0y M0 form the circuit of capital.

In the process of production, means of production simply transfer their value (the amount of labor time necessary to produce a commodity under average conditions) to the final product. The exercise of the power to labor transfers more value than the labor embodied in it. This is because wages that labor (?laborer) gets paid are below the value that she produces for capital. This process is the process of exploitation producing surplus value which is the source of profit. The relation of exploitation has spatial implications as discussed later.

Capital is indeed value in motion. Capital has a restless drive for making money out of money. Accumulation, a positive rate of growth, must happen. But this is not guaranteed. For accumulation is prone to overaccumulation crisis which slows down the rate of accu mulation (consider the extremely slow rate of economic growth in the currently advanced countries). Why? Individual capitals are subjected to coercive laws of competition. To continue being in business and making money, each individual capitalist has to reduce costs below the social average cost. This happens partly through the use of technology which, in turn, displaces labor. But there is a contradiction here. It is the laborers who buy and consume the commodities that are produced. It is they who create profit for capital. Also, each fraction of capital sees its own employees as a cost to minimize, so it keeps wages low, which depresses the market and contributes to the overaccumulation crisis (more on this later). Both accumulation and overaccumulation of capital are spatial processes.

- Capital and Space

- Business Service Geographies – Global Cities, Service Offshoring, and the Second Global Shift

- Business Services – the Body and Emotional Labor

- Explaining the Growth of Business Service Firms

- Characteristics of Business Service Firms

- Measuring Business Services in National Economies

- Defining Business Services

- Business Services

- New Issues